ATEC Publishes 2025 Pipeline Report

New Mechanic Certificates Jumped In 2024, But Technical Workforce Gap Concerns Remain

Pace of demand and retirements will help cut into, but not eliminate, projected shortage

JENKS, Oklahoma--The US aviation maintenance industry posted its second-largest year-over-year increase in new mechanic certificates in 2024, bolstered by more output from FAA-certificated training schools. While this trend is positive, the demand for new mechanics to satisfy industry growth and retirements is still projected to outpace supply, according to the 2025 Pipeline Report from the Aviation Technician Education Council (ATEC) and Oliver Wyman.

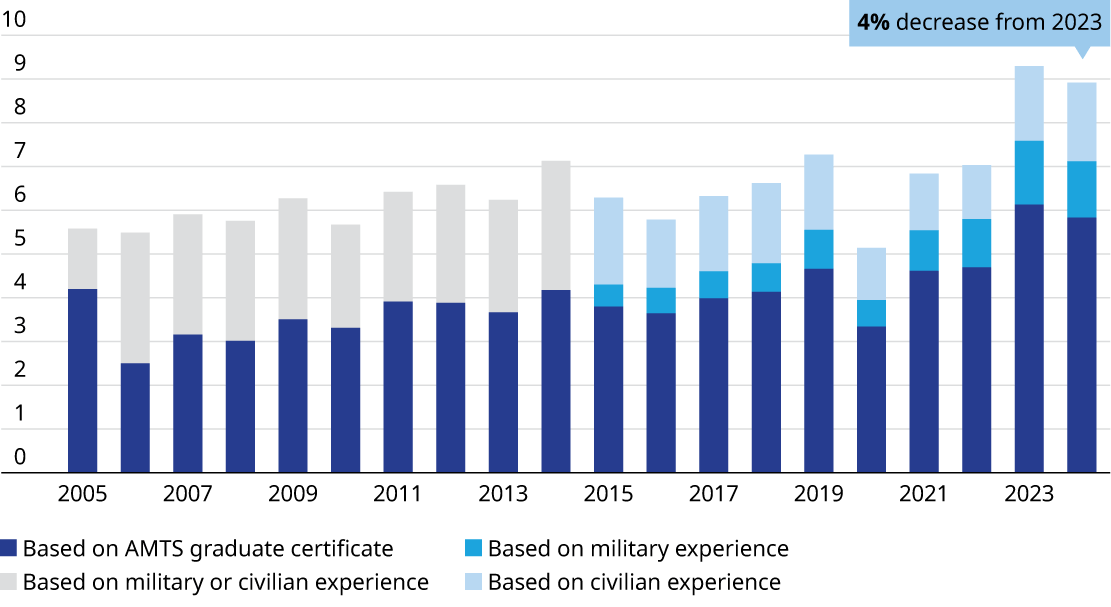

The Pipeline Report shows that the FAA issued slightly more than 9,000 new mechanic certificates last year. The figure is just 4% below 2023's record-setting annual total of 9,401.

Aviation maintenance technician schools (AMTS) saw total graduates decrease just slightly (by 5%) from 2023's record-setting 10,000+. And enrollment increased by 9%, suggesting that efforts to increase AMTS contributions to the pipeline are paying off.

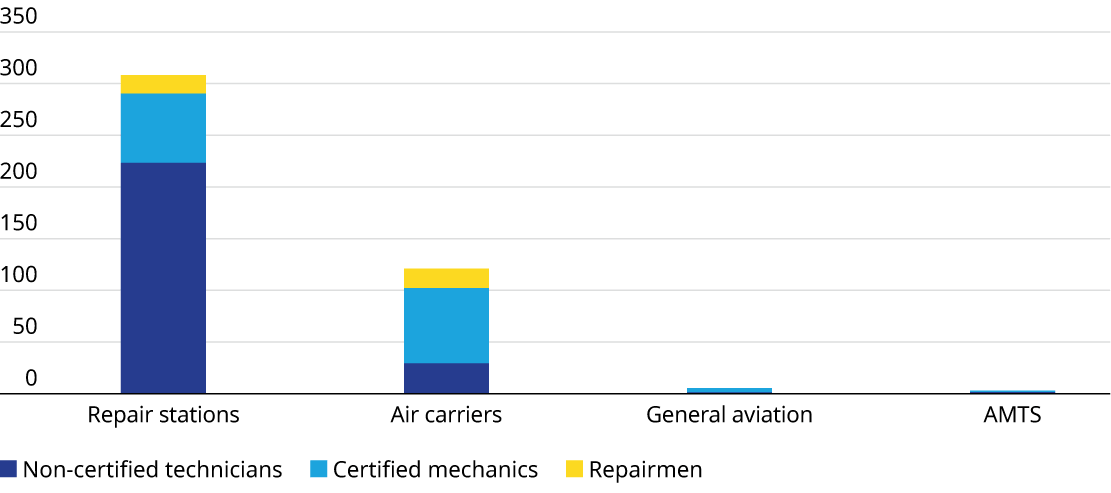

The US civil commercial aviation maintenance workforce—including both certificated mechanics and non-certified technicians—includes more than 431,000 personnel. Over-supply is not a concern.

Demand from commercial air transport alone is expected to drive a 10% shortage in certificated mechanics in 2025. This gap will narrow to 7% by 2035, but will still represent a shortage of 10,000 certificated mechanics just to keep commercial passenger and cargo aircraft flying. Add in demand from business and general aviation fleets, and pressure on the technical workforce pipeline increases even more.

"We're seeing some measurably positive trends at the grassroots level, building interest in pursuing aviation maintenance and the training needed to earn an FAA certificate," said ATEC President and WSUTech Vice President Aviation & Workforce Development Jim Hall. "Near-term challenges will include bolstering these trends while ensuring that we have enough specialized personnel, notably instructors and examiners, to support it."

Among the notable trends:

- Two-thirds of new mechanics obtained certification through an A&P school, with the remainder earning certification through military experience (14%) or work experience (20%).

- FAA figures show one-third of certificated mechanics were engaged in general aviation or working for repair stations, air carriers, or AMTS in 2024. Certificated mechanics represent 61% of the air operator maintenance workforce, 22% of the repair station workforce, and 86% of the general aviation workforce.

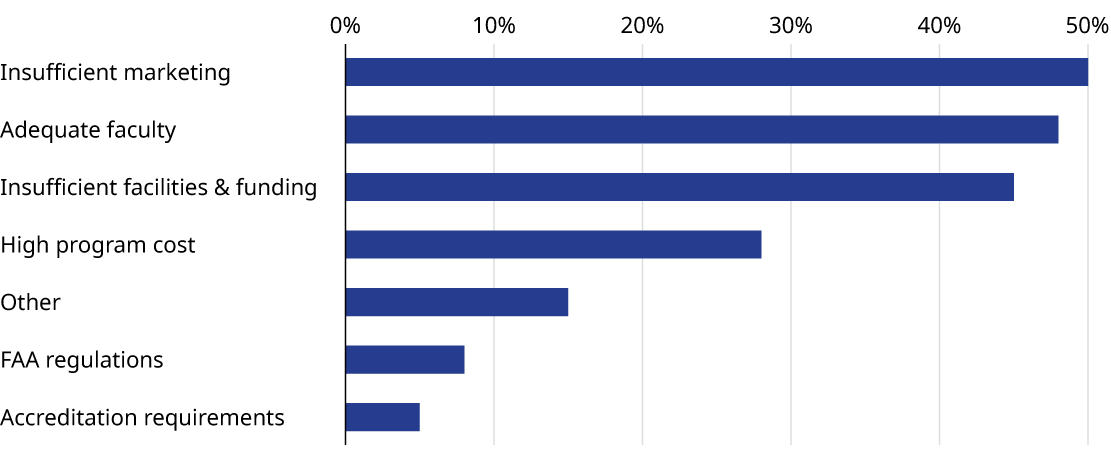

- While AMTS enrollment rose 9% year-over-year, the A&P instructor workforce remained flat in 2024. This underscores the growing gap between teacher supply and demand and the challenges programs face in hiring and retaining certificated instructors.

- AMTS enrollment's uptick is encouraging, but about one-third of available seats remain unfilled. The lack of awareness of aviation maintenance as a rewarding career path and instructor shortages are the leading contributors to below-capacity enrollment.

The Pipeline Report is produced annually by ATEC and Oliver Wyman to spotlight U.S. airframe and powerplant (A&P) mechanic workforce trends. It is composed of insights from an annual survey, analysis by subject matter experts in both organizations, and data from the FAA and other publicly available sources.